California-based machine data analytics company Sumo Logic jumped 22 percent on its first day of trading Thursday, closing the day at nearly $27 a share.

Sumo Logic, which will trade on Nasdaq under the symbol SUMO, priced its initial public offering (IPO) at $22 a share, with 14.8 million shares of its common stock being offered. The company had initially estimated that shares would be priced between $17 and $21.

The offering is expected to close on September 21 and the company expects gross proceeds to reach $325.6 million. Sumo Logic has also granted underwriters a 30-day option to acquire an additional 2.22 million shares at the IPO price.

Founded in 2010, Sumo Logic has developed operations intelligence and security intelligence solutions that provide a wide range of capabilities, including cloud monitoring and management, log management, and SIEM.

The company claims to have more than 2,100 customers around the world, including several major airlines, media companies, cybersecurity firms, universities, financial services providers, and software companies.

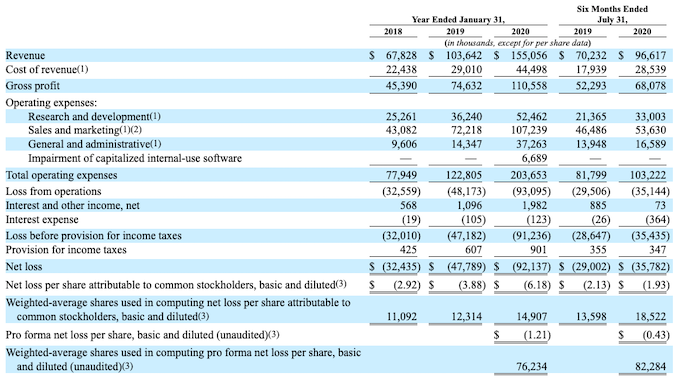

Sumo Logic has raised a total of $345 million, including $110 million last year. In 2019, the company’s revenue exceeded $100 million and it has already made nearly $100 million in the first half of 2020. However, for last year the company reported a loss of more than $92 million.

Related: Sumo Logic Acquires JASK to Expand Cloud-Native Platform

Related: Ping Identity IPO Shares Priced at $15

Related: Tenable Soars on IPO Day