Early stage cybersecurity deals continue to surge in terms of valuation and round size, and cyber may be more resilient to economic conditions compared to other verticals, cybersecurity venture capital firm and incubator DataTribe said in its latest Insights report.

According to the Washington, D.C.-based company, the volume of seed and Series A funding rounds in the cyber sector has remained steady in the first quarter of 2021.

While the economic downturn has had some impact on the overall deal volume across all verticals, cyber deals are expected to be more resistant.

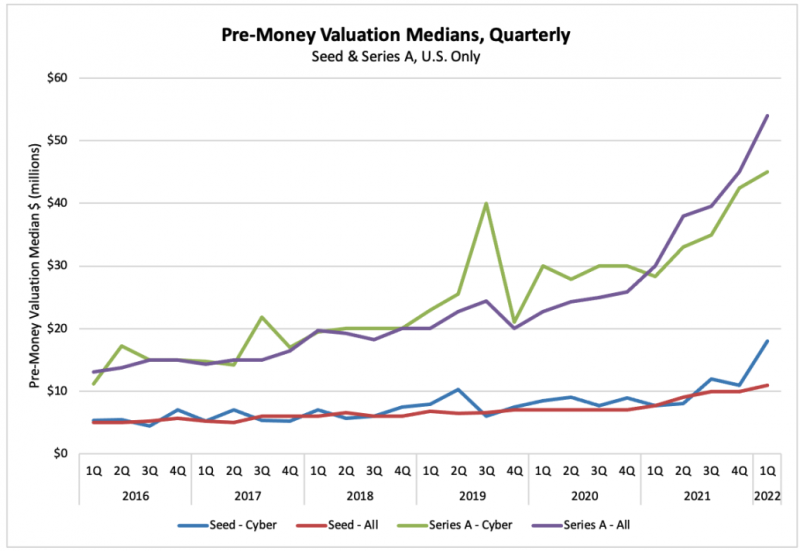

DataTribe reported that the size of cyber seed deals has increased year-over-year by 87% (from $2.7 million in Q1 2021 to $5 million in Q1 2022), and by 35% for Series A deals (from $10 million in Q1 2021 to $13.5 million in Q1 2022). As for valuations, they increased by 133% for seed deals (from $7.7 million to $18 million) and 59% for Series A deals (from $28.3 million to $45 million).

Deal valuations and sizes across all verticals are expected to decrease if the economic downturn continues, but, again, cyber is expected to be more resilient, driven by cybercrime and the cyberspace component of global conflicts.

[READ: M&A Activity to Continue; Growth Funding to be More Conservative]

DataTribe’s report also summarizes the impact of the Ukraine war on IT and software development teams. According to some estimates, the war has led to 200,000 engineers in Ukraine, Russia and Belarus being impacted by the conflict, and another 300,000 from Ukraine are expected to be affected by the conflict down the road.

“Enterprises and ISVs are scrambling to backfill their offshore teams via other regions such as India and Latin America. This hits in addition to the staffing pressures caused by COVID-19 and the Great Resignation, making it very difficult to start new projects or expand teams,” DataTribe said. “This displacement of talent will likely have an impact in all phases of software development for all sizes of organizations. Since outsourcing, in particular, is more affordable and flexible than hiring employees, startup innovation will slow.”

DataTribe’s report also offers insight on breach and attack simulation (BAS) systems, the push for software bill of materials (SBOM), cyber insurance for small and medium businesses (SMBs), and the positive impact of new federal regulations on cyber preparedness.

Related: Risk Intelligence Company Strider Raises $45 Million

Related: Privacy Enhancing Tech Startup Enveil Bags $25 Million Investment

Related: Early Stage Investment in Cybersecurity Shows Signs of Stabilization

Related: Impact of Coronavirus Outbreak on Early Stage Venture Investment in Cybersecurity