Venture capital (VC) funding in the cybersecurity sector totaled $18.5 billion in 2022, a significant decline compared to the previous year, according to a new report from financial advisory firm Momentum Cyber.

Cybersecurity companies raised money across more than 1,000 deals last year, but the total investment dropped by 39% compared to 2021, when companies raised a record-breaking $30.4 billion. Still, the total raised in 2022 exceeds any other year — it represents an increase of nearly 50% compared to 2020.

Security startups have raised roughly $79 billion across more than 4,200 deals since 2018, according to Momentum Cyber.

In 2022, there were 95 instances of companies raising more than $50 million and over 15 new cybersecurity unicorns were announced.

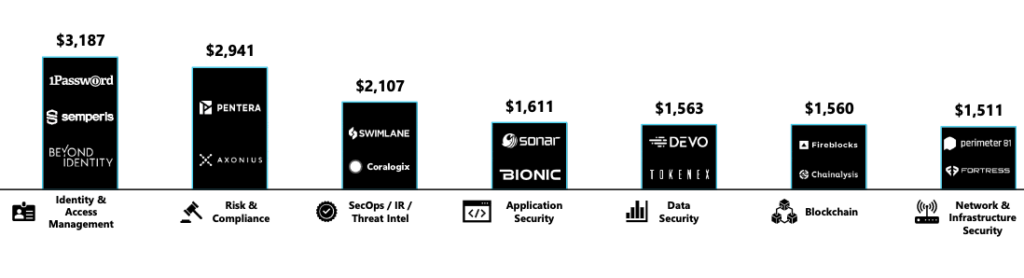

The top sectors in terms of financing volume were identity and access management (IAM), risk and compliance, incident response and threat intelligence, application security, data security, blockchain, and network and infrastructure security.

Momentum Cyber has cataloged 263 cybersecurity-related mergers and acquisitions (M&A). The most active area in terms of M&As was managed security service providers (MSSP), with 46 deals, followed by risk and compliance, IAM, and consulting.

An M&A analysis conducted by SecurityWeek also found that MSSPs were involved in most of the cybersecurity deals in 2022. However, SecurityWeek tracked more than 450 transactions last year.

Momentum’s analysis of the exits announced between Q1 2021 and Q4 2022 showed 38 companies with a deal value ranging between $50 million and $250 million, with a median age of 7 years and medium funding of $23 million. As for a deal value exceeding $250 million, there were 25 companies, with a median age of 10 years and $62 million in funding.

More than 40% of the cybersecurity exits were companies that received early stage funding. There were 64 firms with Series A and Series B funding (median funding of $52 million) and the same number of companies with Series C funding (median funding of $180 million).

The report lists several IPO candidates, with a median funding of nearly $1 billion, including Arctic Wolf, Lacework, Exabeam, Illumio, Netskope, Pindrop, Qomplx, Snyk and Tanium.

Momentum Cyber’s 2023 Cybersecurity Almanac is available in PDF format.

Related: Cybersecurity Financing Declined in Q2 2022, But Investors Optimistic

Related: SecurityWeek Analysis: Over 450 Cybersecurity M&A Deals Announced in 2022

Related: Cybersecurity M&A Activity to Continue; Growth Funding to be More Conservative