Following a proposal by MasterCard back in May 2012 to form a cross-industry group to help drive the adoption of EMV technology in the United States, the Smart Card Alliance on Tuesday announced the formation of an independent, cross-industry organization called the EMV Migration Forum.

According to announcement from the Smart Card Alliance, the Forum will “support the alignment of the EMV implementation steps required for global payment networks, regional payment networks, issuers, processors, merchants, and consumers to successfully move from magnetic stripe technology to secure EMV contact and contactless technology in the United States.”

According to announcement from the Smart Card Alliance, the Forum will “support the alignment of the EMV implementation steps required for global payment networks, regional payment networks, issuers, processors, merchants, and consumers to successfully move from magnetic stripe technology to secure EMV contact and contactless technology in the United States.”

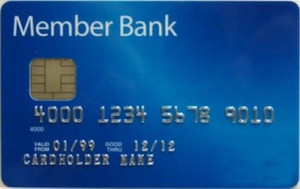

“EMV” technology—the name coming from its original creators Europay, MasterCard, and Visa—uses an embedded microchip and a personal identification number (PIN) to validate the card, its owner, and authorize payment transactions instead of a cardholder’s signature.

Popular in Europe, cards using EMV chip technology help reduce card fraud resulting from counterfeit, lost and stolen cards. Additionally, the technology can enable transactions across contactless, mobile, and remote payment channels.

All major card brands including American Express, Discover, MasterCard and Visa have announced their plans for moving to an EMV-based payments infrastructure in the U.S. According to the Smart Card Alliance, payment processor mandates in are in place for 2013, and major changes for managing fraud risk are set for 2015.

“The migration to EMV in the U.S. is inevitable. We can anticipate that there will continue to be a strong push to migrate to a new chip and PIN payment architecture in the United States, fueled by multi-national merchants who have seen fraud/chargeback benefits from implementations in other parts of the world,” according to Christopher Justice in a 2011 SecurityWeek column.

“The migration will be neither fast nor inexpensive, requiring a hefty investment in new technology and new processes. Both merchants and consumers will need to continue to build a compelling business case for migration to chip and PIN cards in order to convince issuers and acquirers to change the payment infrastructure that is currently in place,” Justice added.

“We have seen in other markets around the world that cooperation and alignment of all participants’ activities are necessary to ensure that the migration to EMV-enabled cards, devices, and terminals is efficient, timely, and effective,” said Randy Vanderhoof, executive director of the Smart Card Alliance. “Industry stakeholders have called for a neutral forum to play this role for the U.S. market. By creating an organization that brings together all of the payments stakeholders who have a direct role in the EMV migration in the U.S., without regard to their past or present involvement with smart cards or other chip technologies, the EMV Migration Forum will be able to focus on the needed coordination and cooperation across the payments landscape.”

The EMV Migration Forum will have a separate membership from the Smart Card Alliance and be fairly open to ensure that all stakeholders in the payment industry can be represented.

The forum will address topics requiring industry cooperation including guidance on technical issues, developing best practices and educational materials, the coordination of process-related elements of the payments infrastructure necessary to introduce an EMV-enabled payment system and more.

“The Alliance is taking this step to create the EMV Migration Forum to leverage the strong collaborative environment around chip-enabled payments we’ve built within our membership and extend that environment to the broader issuers, merchants and consumer market. Our current members have been very supportive and eager to establish an EMV-focused organization to assist the payments industry with this all-important migration,” said Smart Card Alliance Board Chair Willy Dommen, Accenture.

“Merchants and issuers have been looking for unified direction and guidance, and this announcement promises to meet that need,” said Julie Conroy McNelley, research director for Aite Group’s retail banking practice.

“EMV’s arrival in the U.S. has profound implications for issuers, merchants and the entire payments industry. While the global EMV experience will help, the devil is in the implementation details and common U.S. approaches will be needed for a smooth EMV transition,” said George Peabody, Mercator Advisory Group’s director of emerging technologies.

The EMV Migration Forum will kick off with its first meeting on September 12-13, 2012, at MasterCard’s headquarters in Purchase, New York.

Additional information about the EMV Migration Forum can be found here.

Related Reading: Will the U.S. be Able to Fend Off the EMV Card Standard Invasion?

Related Reading: Bank of America Starts Rollout of Chip Credit Cards to Consumers

Related Reading: Bank of America to Offer EMV Technology to U.S. Corporate Card Customers